How to value Bitcoin?

ARK Invest provides a novel method of valuing Bitcoin using on-chain metrics. Traditional assets, like stocks or real estate, have well-established metrics and methods for valuation (e.g., Price-to-Earnings ratio, Net Asset Value, etc.). However, Bitcoin and other cryptocurrencies have unique characteristics that require new methods of valuation.

Ark Invest Framework In Simple Terms

Imagine Bitcoin as a product in a store. These metrics help us understand:

- How much people paid for it versus its current price (MVRV).

- How its price compares to the cost of producing it (MVTV).

- The real money invested in it, excluding production costs (Investor Capitalization).

- How often it's being bought now versus in the past (SLRV).

- When people are selling it to make a profit (RPV and STH P/L).

- If sellers are getting tired and running out (Seller Exhaustion).

Let's break down the key points from the framework:

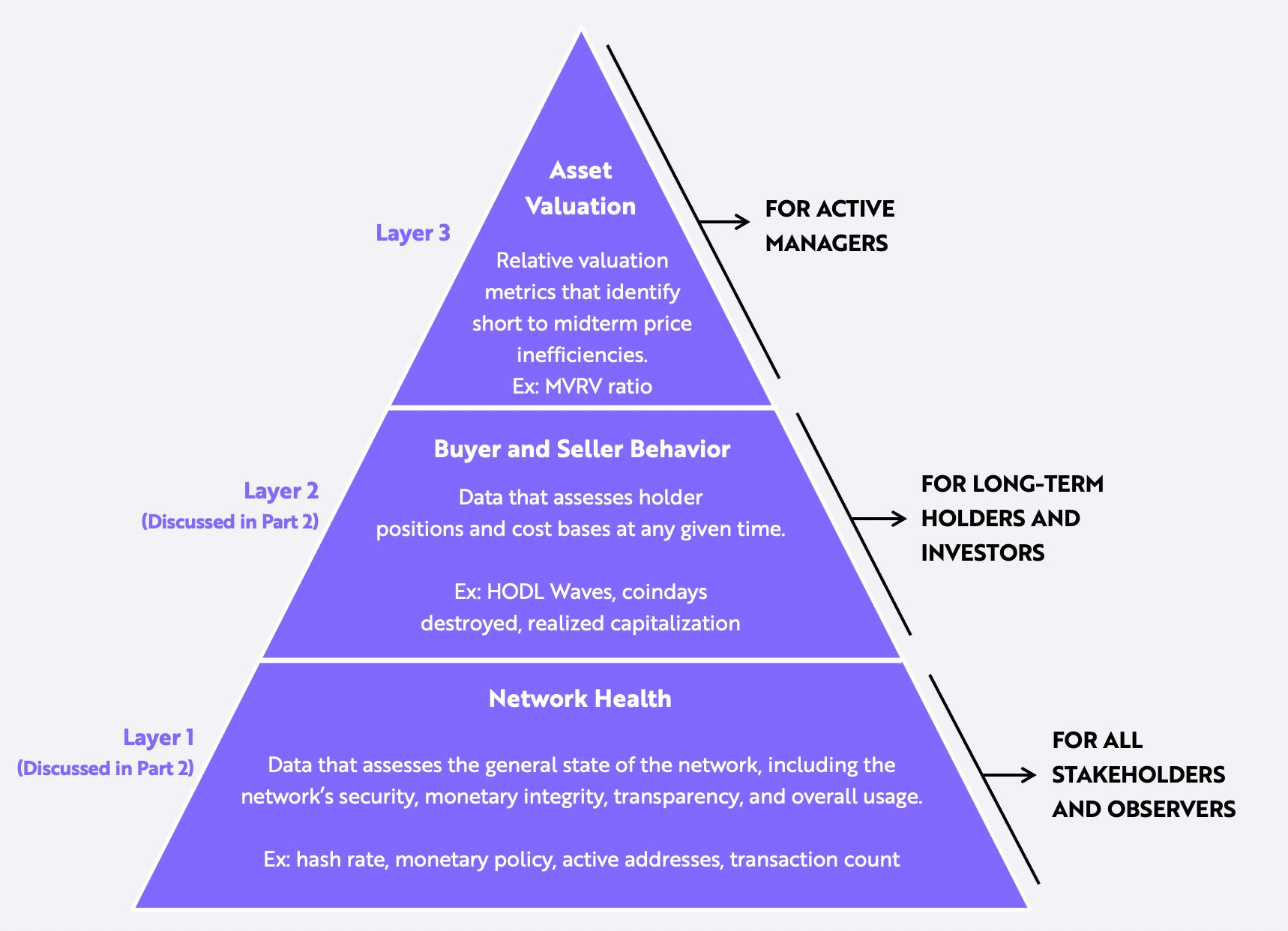

1. Three-layered pyramid

The framework is based on a three-layered pyramid:

- Bottom Layer: Assesses the health of the Bitcoin network.

- Middle Layer: Assesses Bitcoin investors’ positions and cost bases.

- Top Layer: Offers buy and sell signals based on relative-value metrics.

2. Cost basis metrics

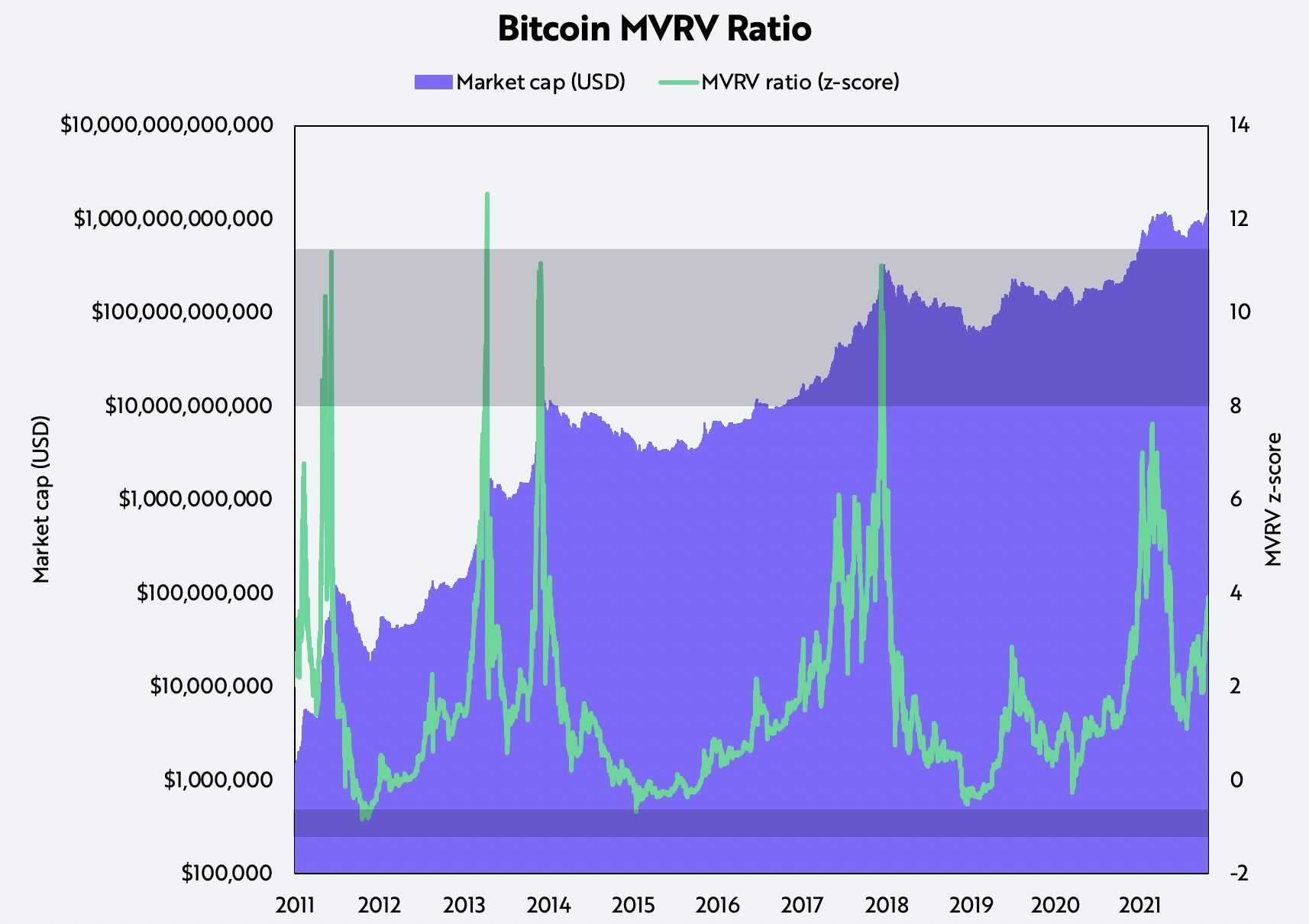

Market-Value-to-Realized-Value (MVRV) Ratio

- What it is: This compares the current total value of all Bitcoins (market capitalization) to the value at which they were last moved (realized capitalization).

- Why it's important: It gives an idea of whether Bitcoin is being sold at a profit or loss. If the ratio is below 1, it suggests many people are selling at a loss.

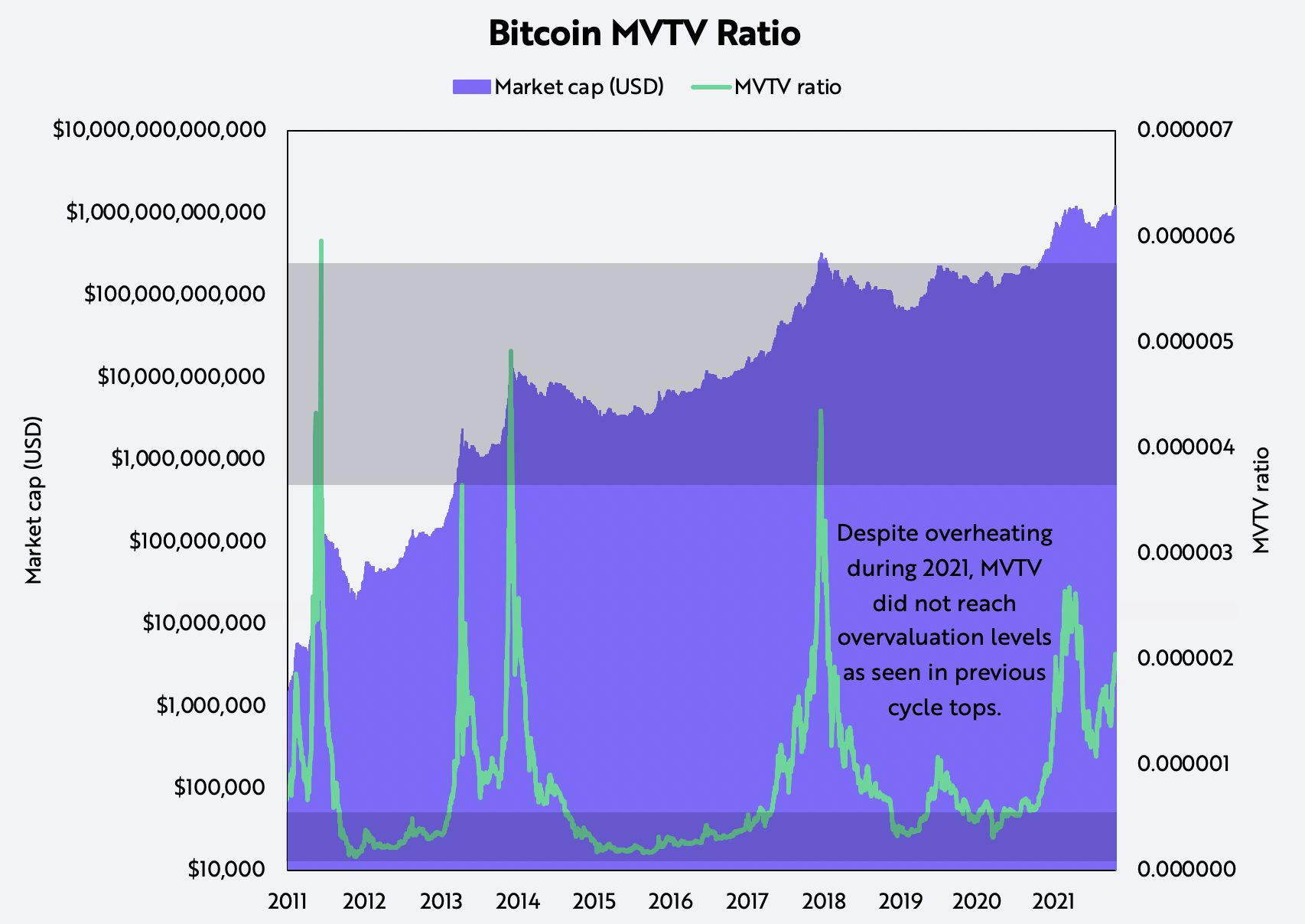

Market-Value-to-Thermo-Value (MVTV) Ratio

- What it is: This compares the current total value of all Bitcoins to the total value of rewards paid to miners.

- Why it's important: It indicates how much value investors give to Bitcoin in comparison to the amount miners are paid to maintain the network.

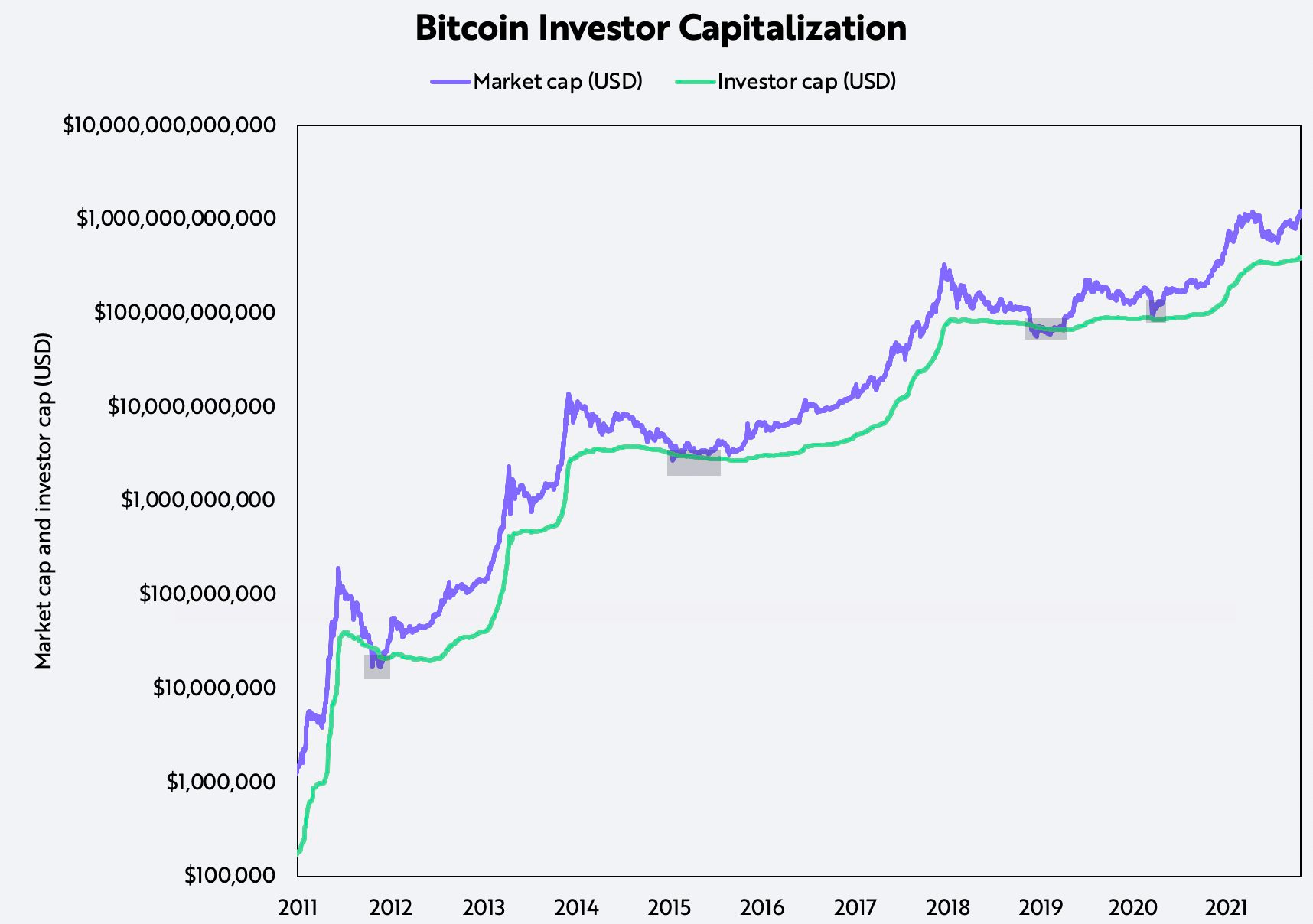

Investor Capitalization

- What it is: This is the total value of all Bitcoins minus the amount paid to miners.

- Why it's important: It helps indicate the "fair value" of Bitcoin, especially during market lows. It subtracts the mining costs to give a clearer picture of the actual investor money in the market.

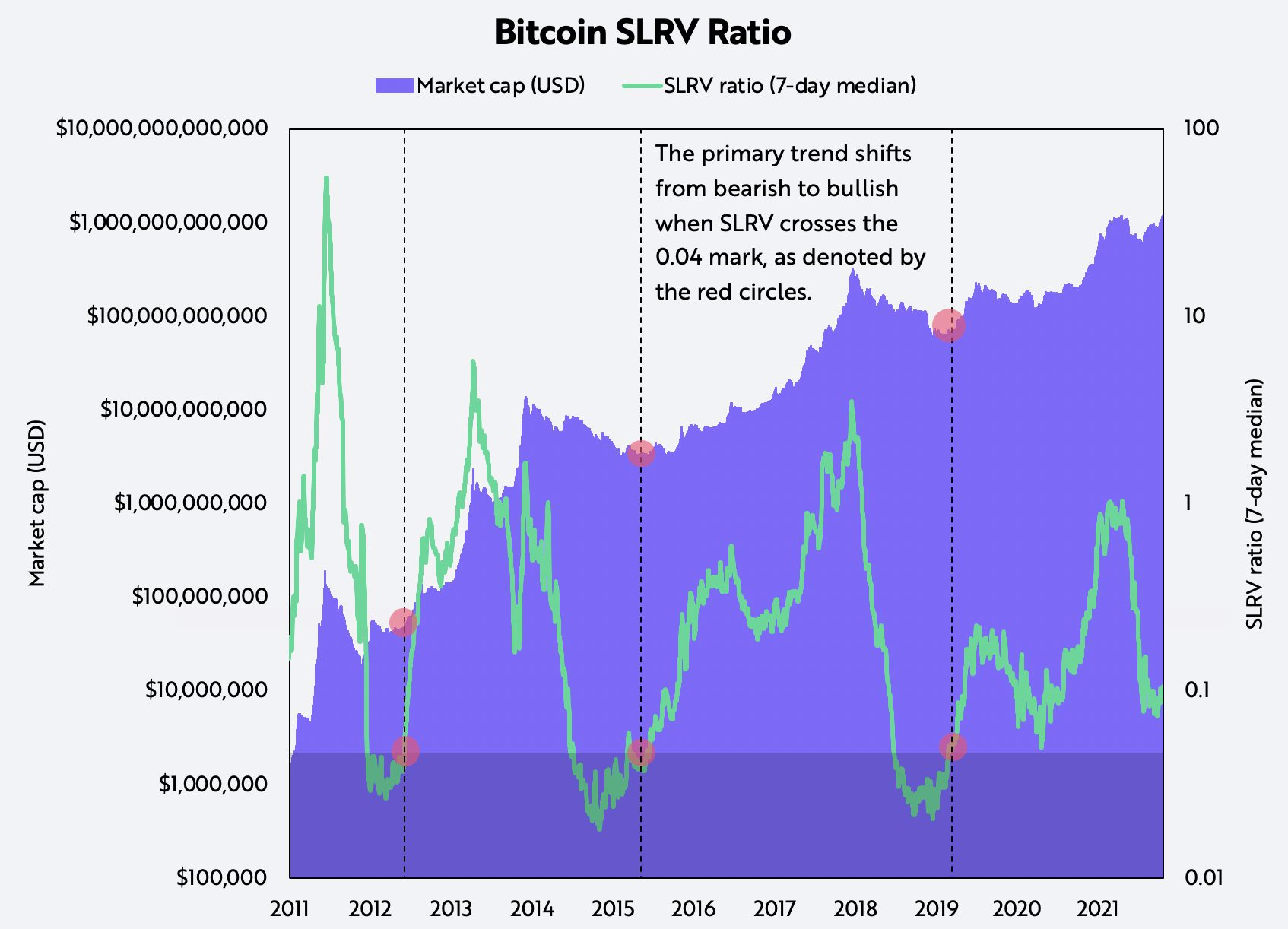

Short-to-Long-Term-Realized-Value (SLRV) Ratio

- What it is: Compares the recent movement of Bitcoins to the movement between 6 months to a year ago.

- Why it's important: It indicates market activity. A low ratio might mean investors are holding onto their Bitcoins, suggesting market apathy, while a high ratio might suggest a more active market.

3. Profit and Loss metrics

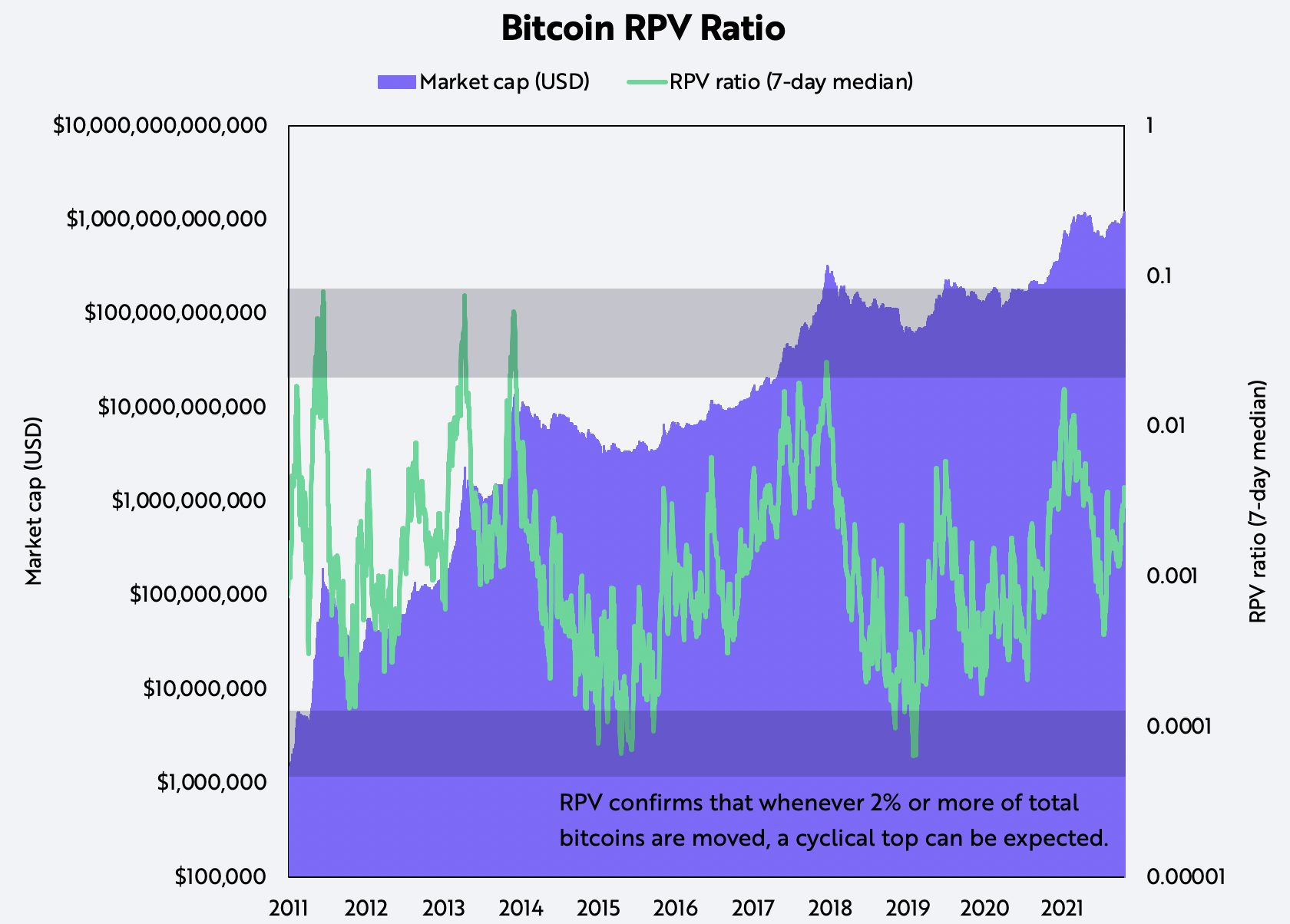

Realized Profits-to-Value (RPV) Ratio

- What it is: The amount of profit taken by Bitcoin sellers compared to the average cost of all Bitcoins.

- Why it's important: It shows when a lot of people are taking profits. High levels of profit-taking often precede market tops.

Short-Term-Holder Profit/Loss (STH P/L) Ratio

- What it is: Compares the profit or loss of those who've held Bitcoin for a short time (less than 155 days).

- Why it's important: It provides a sense of market sentiment among newer investors. A ratio less than 1 means most recent investors are at a loss, which can be a bearish sign.

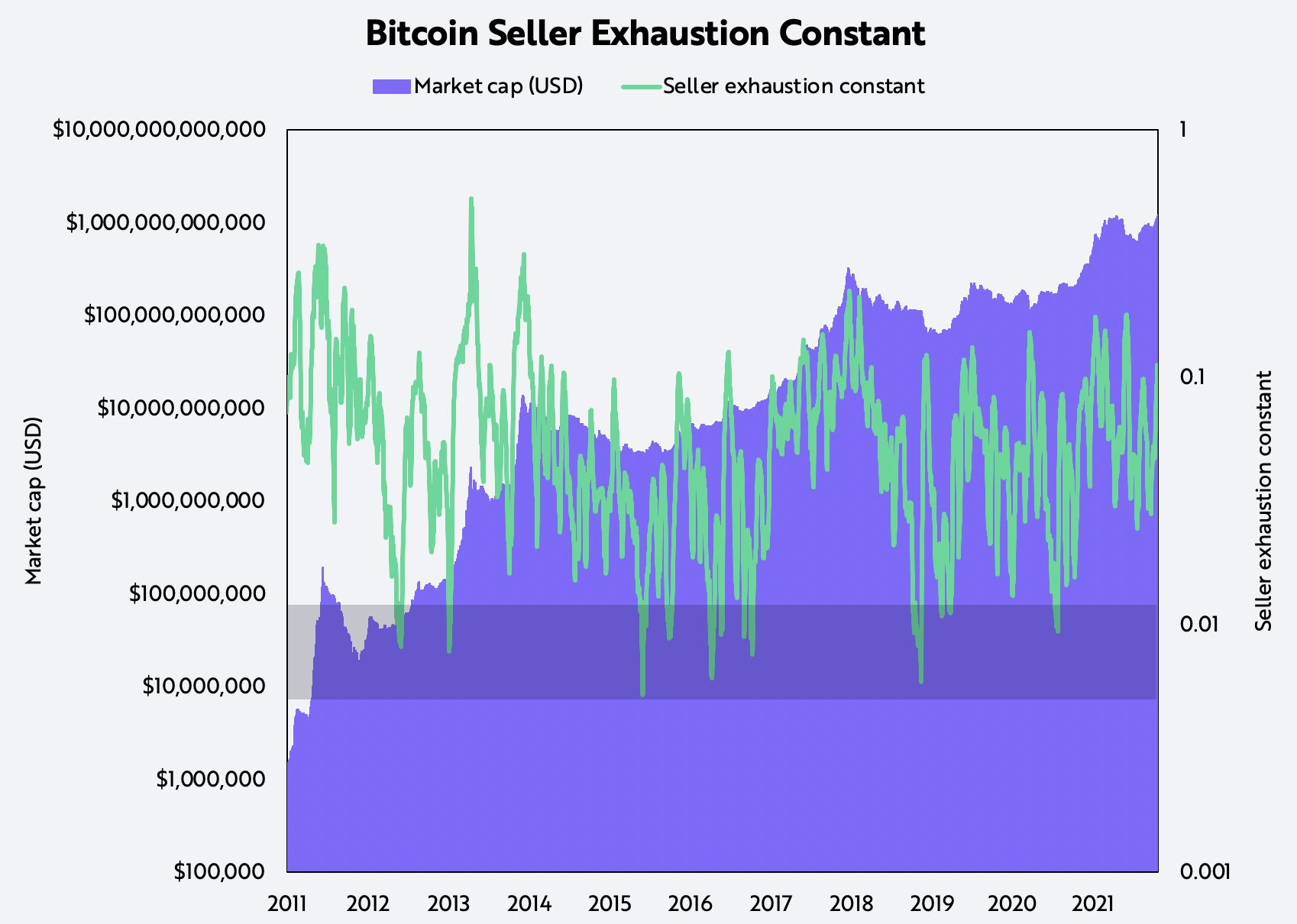

Seller Exhaustion

- What it is: It's a combination of the amount of Bitcoin in profit and its recent price volatility.

- Why it's important: It can indicate potential market turning points. If there's low volatility and many holders are at a loss, it might mean the market is nearing a bottom.

To Summarize: In Simple Terms Again

Imagine Bitcoin as a product in a store. These metrics help us understand:

- How much people paid for it versus its current price (MVRV).

- How its price compares to the cost of producing it (MVTV).

- The real money invested in it, excluding production costs (Investor Capitalization).

- How often it's being bought now versus in the past (SLRV).

- When people are selling it to make a profit (RPV and STH P/L).

- If sellers are getting tired and running out (Seller Exhaustion).

By understanding these, investors can make more informed decisions about buying or selling Bitcoin.

Conclusion

The main takeaway is that ARK Invest believes that the valuation of Bitcoin, as an asset, should be based on its economic utility. For the cryptocurrency bitcoin, its value should be determined by its supply and demand dynamics. The on-chain metrics, which are unique to cryptocurrencies, can offer insights into the health of the Bitcoin network, investor behavior, and potential price movements.

In essence, ARK Invest is proposing a way to evaluate Bitcoin by looking directly at the blockchain data, rather than using traditional financial metrics. This is a reflection of the unique nature of cryptocurrencies and the need for innovative analytical tools in this space.